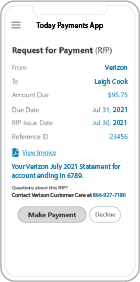

Requests Payments

What is Requests Payments

Requests Payments is an exciting new service brought about by the Faster Payments Initiative of the FedNow ™ US Federal Reserve providing payments that are instant, final (irrevocable - "good funds") and secure.

Real-Time instant payments, are defined simply as: Irrevocably collected funds in a bank account and usable immediately by the owner of the account. Our "Good Funds" payment gateway allows for instant real-time digital payments that are immediate, irrevocable, intra-bank and/or interbank account-to-account (A2A) transfers that utilize a real-time messaging system connected to every transaction participant through all U.S.-based financial institutions. Funds are available for use by the receiver and real-time confirmation is provided to both you ("the sender") and receiver in seconds. Most Good Funds transactions are "Credit Push" versus "Debit Pull."

Implementing recurring Requests for

Payments (RFPs) for both B2B and B2C transactions with

real-time payment systems can offer efficiency and

convenience. Here's how it works:

- Recurring Requests for

Payments:

- RFPs are established for

regular, scheduled payments, whether it's daily,

weekly, monthly, or based on a custom frequency.

- These recurring requests

are automatically generated and sent to the payer at

the designated intervals, reducing manual effort and

ensuring prompt payments.

- Variable Pricing:

- For transactions with

variable pricing, such as utility bills or usage-based

services, RFPs can accommodate fluctuating payment

amounts.

- Each billing cycle, the

RFP reflects the current amount owed based on usage,

consumption, or any other variable factors.

- Stable Pricing:

- In contrast, RFPs with

stable pricing involve fixed payment amounts that

remain consistent from one billing cycle to the next.

- This is common for

subscription services, memberships, or installment

plans with standardized fees.

- Real-Time Payment Systems:

- Leveraging real-time

payment systems like RTP (Real-Time Payments), FedNow,

or instant payment platforms ensures swift and secure

fund transfers between payer and payee accounts.

- When the payer receives

the RFP, they can authorize the payment through their

preferred method, with funds transferred instantly or

within minutes.

- B2B and B2C Transactions:

- Recurring RFPs can be

tailored for both B2B and B2C transactions, catering

to the needs of businesses and individual consumers

alike.

- B2B transactions may

involve recurring payments for services,

subscriptions, or contractual agreements.

- B2C transactions may

include recurring payments for utilities, rent,

mortgage, or subscription-based services.

- Digital, Texting, or Paper

Invoicing:

- RFPs can be initiated

through various channels, including digital invoicing

platforms, text message notifications, or traditional

paper invoices.

- Regardless of the

communication method, the payment process remains

seamless and efficient, with real-time payment systems

facilitating instant fund transfers.

By implementing recurring RFPs with

real-time payment systems, businesses can streamline their

billing processes, improve cash flow management, and enhance

customer satisfaction by providing a convenient and reliable

payment experience. Whether the pricing is variable or stable,

real-time payment systems ensure that payments are processed

swiftly and securely, benefiting both businesses and

consumers.

About Requests Payments

RfP FedNow Request for Payment is designed to handle individual payment requests in real-time, but it does not support batch processing. Therefore, each payment request needs to be initiated and processed individually. However, it is possible to set up recurring payment requests, which can be scheduled to occur at specific intervals, such as weekly or monthly. This can be useful for businesses that need to collect recurring payments from their customers, such as subscription services or utility companies.

To set up a recurring RfP FedNow Request for Payment, you would need to create a payment request with the required payment details, including the amount, payment due date, and payment reference. Then, you can set up a schedule for the payment to recur, specifying the start date, frequency, and duration of the recurring payment. The payment schedule can be saved and managed within your RfP FedNow Request for Payment account, and payments will be automatically processed according to the schedule you have set up.

Features & Benefits

FedNow instant payments has benefits for all parties involved in

Financial Transactions.

Benefits to your company include:

Money Transfer: Current limit of $500,000.

Money Transfer: Current limit of $500,000.

It's Fast: 24/7/365 access to funds anytime vs.

several days for paper checks or ACH transfers to process.

Request for Payments ( RfP ™): Mobile & Online Real-Time Bill Payments.

It's Final: All RTP and Instant Payments are Final & Irrevocable.

Software Integration: Integrate your Management

or Enterprise software with us.

Message Detail: Full 145 characters available

using ISO 20022 messaging XML format.

Online Down Payments: Don't use inconvenient

and expensive Wires & Cashier's Checks.

Online Real-Time Reporting: Configured

Dashboard with Virtual Terminal login.

Reduced calls / emails in the "Purchasing Chain": All

parties to a instant payment transaction receive immediately

text & email messaging.

The

FedNow and RTP Systems enables Participants to initiate credit transfers,

receive final and irrevocable settlement for credit transfers,

and make available to Receivers funds associated with such

credit transfers in real-time, twenty-four (24) hours a day,

seven (7) days a week, fifty-two (52) weeks a year. All instant payments are "Credit

Push" instead of "Debit Pull."

Today Payments

...continues to meet the challenge of our clients by offering cost effective "good funds", real-time, instant, credit card, ACH and e-invoice payment processing services into the electronic payment solutions banking system. Electronic banking includes the transfer of funds between companies (B2B) and/or (B2C) consumer accounts for collection and payments. Today Payments Gateway Merchant Services gives your company choices in the method of faster payments that you can accept from your customers.

Our payment processing platform is designed for simplicity and ease-of-use.

SecureQB Cloud payment processing integration for QuickBooks ® give you the Best transaction detail information, real-time, with matching error-proof through QuickBooks.

Process with the Requests Payments Professionals

- Automation of Accounts Receivable Collection with Real-Time Settlement & Deposit

- Automation of Accounts Payable Payments with Real-Time Settlement & Deposit

- One-Time & Recurring Real-Time Credits with Settlement & Deposit

Each day, thousands of businesses around the country are turning their transactions into profit with real-time payment solutions like ours.

Contact Us for Requests Payments payment processing